As a buyer with little information about the market, this kind of argument leaves you in a tight spot where you have to decide on your own, whether buying diamonds online is a wise choice or not. If you are planning to invest in diamonds, your best bet is to rely on trends and statistics rather than personal arguments.

On paper, buying diamonds makes great sense. Think about it, they have high intrinsic value, never seem to go out of demand and last forever. Logistic is never a problem as they are small and portable that makes it easier to store them.

Increase in value over time

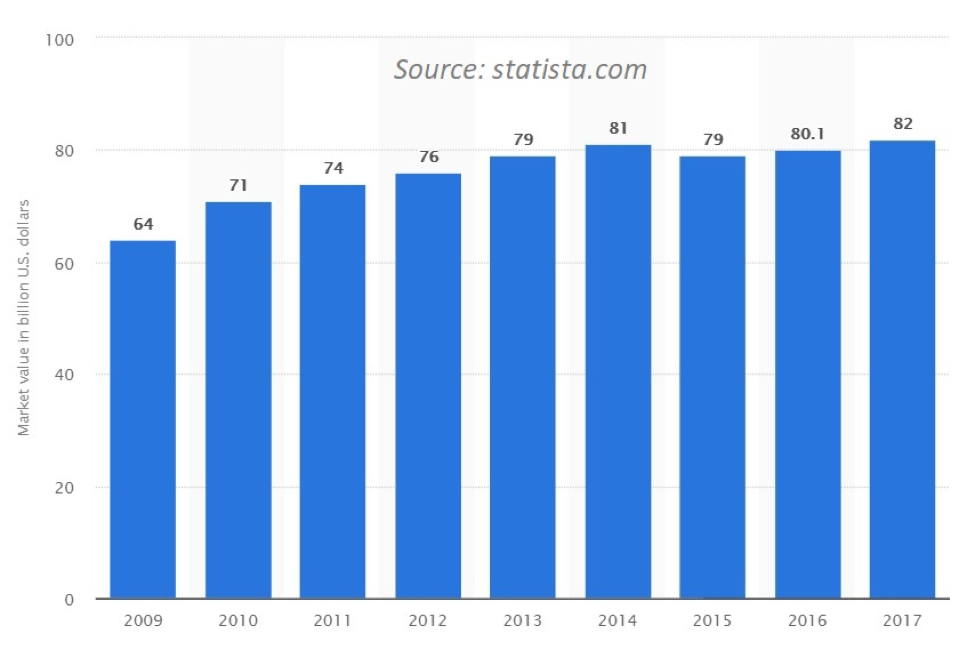

One of the merits of buying diamonds is their appreciating value over time (most of the time). Like every precious metal, the value of diamonds has appreciated over the last decade. According to statista, ever since the global financial crisis of 2008, the diamond industry has shown gradual and steady growth from USD 64 billion in 2009 to USD 81 billion in 2014. But in the following years due to excess availability of polished diamonds the market was flat till 2017 when it was at a peak at USD 82 billion. However, in recent years the surge in the market value of the diamond industry has started again.

Why this is a good time for investing in diamonds?

As the global markets are changing, it is becoming evident that the traditional investment opportunities are no longer delivering the returns as expected. Failing markets and low-interest rates make investing in diamonds look very promising. However, we do not recommend you to invest in diamonds without ensuring that you are aware of the risks and the pitfalls.

With that in mind, we researched deep into the current trends of the diamond industry to bring out the stats that will help you decide whether to buy diamonds or not.

Following a period of high volatility till 2017, the diamond industry is now growing with rough diamond mining industries projecting a growth of 20% in the coming years. In light of the promising numbers, the mainstream profitability is expected to remain positive with a growth margin of 1% to 3%. This implies that if you buy diamonds, you can certainly expect the prices to go up.

Key industry trends diamond buyers must pay attention too

- The increasing influence of digital technologies

According to the annual report on the diamond industry by Bain & Co. and Antwerp World Diamond Centre. The diamond industry will overcome its challenges by 2021. Retail demand for diamonds may remain still in 2020 but it is likely to get more momentum in 2021. According to the report, major diamond jewelry retailers in the US and China reported 13% and 11% increase in their online sales. In the recent industry analysis, GIA claimed that online jewelry shopping was increased during the holiday season while local retail shops reported a decline in foot traffic. MasterCard survey also suggested 9% increase in online jewelry shopping over 2018. A short shopping period between Thanksgiving and Christmas caused a massive impact on retails sales. It decreased the flow of foot traffic to a local store which resulted in increased online jewelry sales. Though the online diamond industry is a small part of overall online business, reports are estimating that 5% to 10% of diamond jewelry is sold online. Signet and Tiffany also reported an increase in online sales in the year 2019. Signet Group reported 11% growth in online sales.

Soon rapid growth of online sales channels, development of lab-grown diamonds and support for the natural diamond industry can make an impact on sales of the diamond industry. E-Commerce or online diamond sales can help sellers to reach the target audience more effectively. E-Commerce has the power to attract Millennials and Generation Z.

Due to maturing digital technologies, the diamond producers, mainstream players and retailers can increase efficiency in regards to operations offering superior customer experiences. Buying diamonds online is another digital trend that is gaining popularity. A company that is one of the most innovating diamond companies is Diamond Hedge. It is one of the best places on the internet for buyers to find certified diamonds. The site allows you to sort diamonds based on shape, carat, cut, color, clarity, and price. On Diamond Hedge, you can compare lab grown and certified natural diamonds all on one platform. You can also buy loose diamonds or engagement rings on the site.

- The growing presence of lab-grown diamonds

This is where we would recommend you to put your money. After De Beers Group launched its line of lab-grown diamond fashion jewelry titled ‘Lightbox Jewelry’ in 2018 that made a dent in the diamond industry. Lab-grown diamonds have been around for some time, even 99% of industrial diamonds are lab-grown but De Beers moved to bring lab-grown diamonds to the jewellery market authenticated their use for personal ornaments. Due to declining production costs and retail prices, we expect lab-grown diamonds to become a lot more accessible to a wider consumer base. For natural diamond miners and manufacturers, it poses a threat as it is expected that by 2030 the demand for natural diamonds will be limited to 5% to 10%. While lab-grown diamond market will project 15% to 20% sales growth in next five years.

Conclusion

According to experts, diamond buyers have no reason to worry as the long-term outlook for the diamond industry remains positive. The expected demand for natural diamonds is expected to grow by up to 2% annually through 2030. Furthermore, the continued growth of the middle class in two major developing economies like India and China, projects a promising front for the increased consumption of diamonds.

Subscribe for free to receive new blog posts.